Tottenham Hotspur 2012 full accounts have been published: loss before tax £7.3m (2011 profit before tax £0.4m)

Thanks to tax credits, THFC loss after tax smaller (than before tax loss) at £4.3m (2011 profit after tax £0.7m).

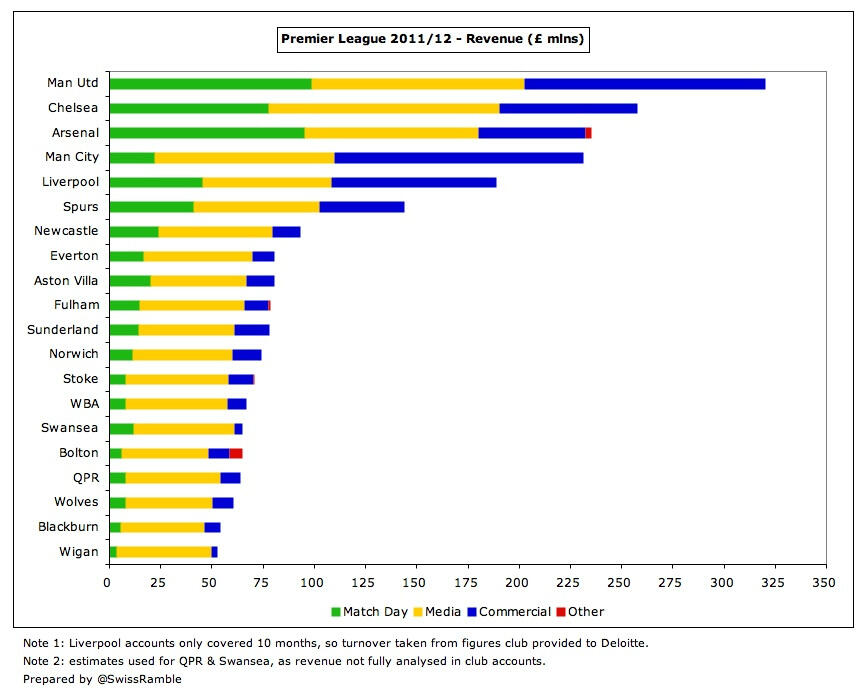

revenue dropped 12% from last year’s record £163.5m to £144.2m, which is still 6th highest in England and 13th highest in the world.

2012 revenue £144.2.5m (2011 £163.5m): match day £41.1m (2011 £43.3m), TV £61.6m (2011 £83.1m), commercial £41.5m (2011 £37.1m).

Main reason for THFC £19.3m revenue fall is going from Champions to Europa, cutting prize money & gate receipts by £30.7m (37.1m to 6.4m).

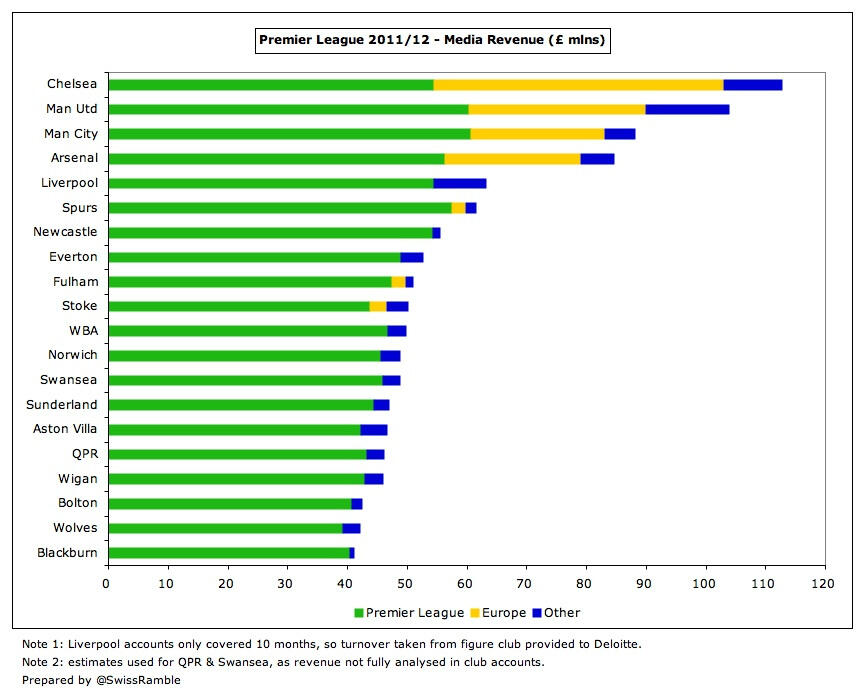

2012 domestic TV revenue up £5m, mainly due to higher league position (4th vs 5th) and 6 more live televised matches.

THFC 2012 commercial income up £4m, mainly due to more revenue from main sponsorship deal, offset by lower merchandising sales

2012 profit on player sales £9.2m similar to 2011 £8.6m, including Crouch, Palacios, Keane, O’Hara, Hutton, Pavlyuchenko and Corluka.

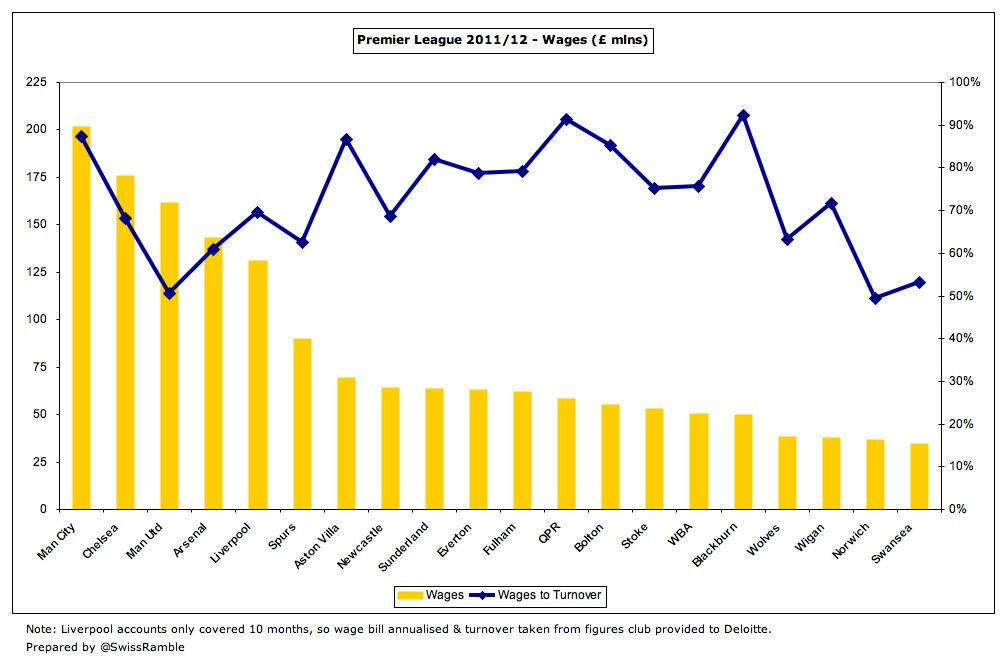

2012 staff costs cut 1% to £90.2m (2011 £91.1m), though wages to turnover ratio rose from 56% to 63% following fall in revenue.

2012 player amortisation fell £14.5m to £25m “as a result of significant player disposals”.

2012 gross debt up £8m to £86m (2011 £78m), comprising bank loans and securitisation funds. Less £16m cash gives net debt of £70m.

Thanks to tax credits, THFC loss after tax smaller (than before tax loss) at £4.3m (2011 profit after tax £0.7m).

revenue dropped 12% from last year’s record £163.5m to £144.2m, which is still 6th highest in England and 13th highest in the world.

2012 revenue £144.2.5m (2011 £163.5m): match day £41.1m (2011 £43.3m), TV £61.6m (2011 £83.1m), commercial £41.5m (2011 £37.1m).

Main reason for THFC £19.3m revenue fall is going from Champions to Europa, cutting prize money & gate receipts by £30.7m (37.1m to 6.4m).

2012 domestic TV revenue up £5m, mainly due to higher league position (4th vs 5th) and 6 more live televised matches.

THFC 2012 commercial income up £4m, mainly due to more revenue from main sponsorship deal, offset by lower merchandising sales

2012 profit on player sales £9.2m similar to 2011 £8.6m, including Crouch, Palacios, Keane, O’Hara, Hutton, Pavlyuchenko and Corluka.

2012 staff costs cut 1% to £90.2m (2011 £91.1m), though wages to turnover ratio rose from 56% to 63% following fall in revenue.

2012 player amortisation fell £14.5m to £25m “as a result of significant player disposals”.

2012 gross debt up £8m to £86m (2011 £78m), comprising bank loans and securitisation funds. Less £16m cash gives net debt of £70m.